India-US Tariff Reset: What It Means for Indian Businesses, Small Firms, and World Supply Lines

Why This Tariff Change Counts Big Time

Trade rules don’t grab headlines much unless they stir up big trouble right away. The fresh tariff reset between India and the United States breaks that pattern in a quiet way. It comes across as straightforward paperwork at first glance, nothing flashy or bold, but for folks running businesses in India, the effects run deep and wide.

Think about the bigger picture today. World trade stumbles along with buyers holding back their cash, nations clashing over borders and resources, and supply chains twisting into new shapes to dodge old risks. Dropping even a bit of worry over tariffs lets companies tweak their prices without second-guessing, map out shipments months ahead, and nail down contracts that last. Small outfits in India, the kind that count every rupee twice because profits hover paper-thin, find huge relief in knowing their costs won’t spike out of nowhere tomorrow.

This write-up digs into the roots of the deal, how it’s built, and the everyday punch it packs for sellers. Numbers come straight from public trade records and official policy drops, no guesses involved.

Past Ties: India-US Trade and Tariff Fights

India and America hold down a powerhouse link in global trade, one that touches lives across both lands. The US tops the list as India’s biggest buyer nation, pulling in everything from factory parts to software code. Yearly swaps of goods and services clock in around $190 to $200 billion, steady climbers over time. Deals span building products, daily services, cutting-edge tech, military hardware, and heavy cash investments flowing in both directions.

Tensions boiled up sharply from 2018 through 2020, though. America pulled the plug on India’s spot in the GSP program, a setup meant to ease tariffs for growing nations. India fired back quick, slapping extra taxes on American apples, bikes, and nuts. Court battles kicked off at the World Trade Organization, dragging on with arguments and rulings. Hit goods tallied about $8 billion, a figure that sounds big but stung worse for those in the crossfire.

Sellers felt the pinch hard. Prices climbed overnight, buyers looked elsewhere, and planning turned into a guessing game. Small players, already juggling tight budgets, saw orders dry up as US shops chased cheaper options from spots without the tax fight.

What’s in the New Tariff Fix and Why Now

Nobody should mistake this for a grand free trade overhaul or blanket tax wipeout. The deal zeroes in on smoothing specific rough edges from past scraps. Core moves include pulling back those revenge tariffs from the dispute days, wrapping up the lingering WTO suits, and both sides nodding to trade grounded in clear, even rules everyone follows.

Pick the timing apart, and it clicks. Supply lines worldwide scramble for safety after shocks like pandemics and wars. Everyday prices bite harder with inflation everywhere. Ties between India and the US stretch far past shopping lists now, weaving in shared tech pushes, defence pacts, and locked-in supply safety nets. Against that backdrop, locking in calm trade outweighs pushing for every last tariff drop.

Hard Numbers Backing the Deal

Trade volumes between the two keep pushing upward year after year, shrugging off dips here and there. India’s edge shines brightest in services, where coders and call centres rake in dollars. Factory-made items pick up steam too, carving bigger slices of the pie. Before this fix, tariff clouds hung over buyer choices, making US firms hesitate on locking India into multi-year supply plans.

Standout fact: the pact adds zero new taxes. In a world where trade barriers pop up like weeds, that alone sends a strong message of open doors and steady hands.

How It Hits Small Indian Firms

Tariffs bite right into the wallet for small firms, shaping if they sink or swim. They jack up the total cost when goods hit US shelves, squeeze what middlemen take home, and pit sellers against rivals from tariff-free zones. Wiping those old revenge taxes hands small Indian outfits a real shot at matching prices, holding ground even when overall profits run lean.

On the sales front, bosses can now crunch numbers for bids without sweating surprise hikes, green-light deals spanning quarters, and shield against wild cost swings. The US market stays premium territory—high payouts but thick with cheques—yet easing tariffs peels away one extra wall, letting focus shift to core strengths.

The daily grind stays real, though. Managers wrestle good tests from labs, stack paperwork for borders, haggle shipping rates, and ride dollar-rupee waves. The tax lift lightens one load, but winning demands sharp ops from top to bottom.

How It Helps Big Firms and Global Players

Larger sellers and worldwide giants breathe easier with clearer horizons. Costs to US doors firm up, letting finance teams sleep better. Rule fog lifts, smoothing expansion bets. India pitches stronger as the prime spot for steady output and sourcing. “Skip China” hunts get a nod here. Tax steadiness cements India as a trusted hub, drawing factories and deals that stick.

Hits by Industry

- Factory and machine goods makers grab quick wins. Car bits and heavy tools compete more fiercely now, slipping smoother into American assembly lines where every part counts. Long-term buyer lists open wider.

- Clothes and fabric sellers snag slim but vital cost breaks. In cutthroat price wars, that edge reclaims shelf space lost to others.

- Farm goods and ready eats see side gains. Direct tax hits stay light, but firm rules back speciality packs like spices or nuts aimed at picky eaters.

- Electronics bits ride the wave. Build jobs and snap-together units that flow freer, matching India’s drive to crank out gadgets.

- Services dodge tax nets mostly. Still, warmer ties breed trust, key for remote coders and advisors chasing fat contracts.

Openings for Indian Sellers and Starters

Tax calm sets groundwork, leaves heavy lifting to hustlers. Small sellers eye US ramp-ups. Factories tune for export life. Buyer bonds deepen over years. Team ventures spark new plays. Outfits primed for push reap the biggest hauls.

Dangers, Limits, and Tough Spots

Eyes wide open stays smart. Vote winds shift trade paths. Non-tax hurdles tower: tests, stamps, hauls, and cash swings. Fix sand bumps and leaves roots dug in.

Long-Run Effects on India’s Cash Flow and World Spot

Years out, steadiness roots deep. Seller guts firm. World lines weave India tight. Choosing fair play over scraps shouts maturity.

Conclusion

The India–US tariff reset is not transformational on its own. Its importance lies in what it signals: a shift from dispute-driven trade to pragmatic alignment.

For Indian businesses, the message is clear. Policy friction is reducing. Execution now matters more than ever.

FAQs

- What is the India–United States tariff deal, and what does it include?

The India–US tariff deal refers to the mutual removal of retaliatory tariffs imposed during earlier trade disputes and the closure of related WTO cases. It is not a free trade agreement but a trade normalization step aimed at reducing friction, improving predictability, and stabilising bilateral trade conditions for businesses in both countries.

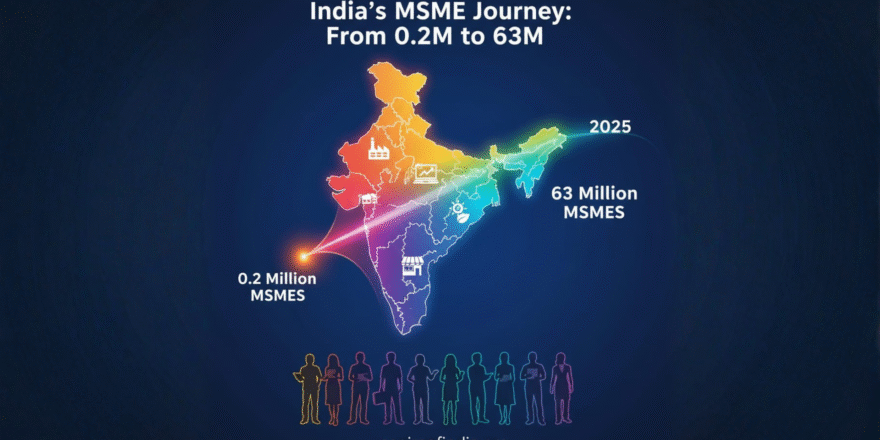

- How does the India–US tariff deal impact Indian MSMEs and small exporters?

The deal lowers tariff-related cost uncertainty for Indian MSMEs exporting to the US. This improves price competitiveness, helps MSMEs quote more stable export prices, and reduces the risk of sudden margin erosion. However, MSMEs must still comply with US quality standards, certifications, and logistics requirements to fully benefit.

- Which Indian sectors benefit the most from the India–US tariff reset?

Sectors with direct merchandise exports benefit the most, including manufacturing, engineering goods, auto components, textiles, select agricultural and processed food products, and electronics. Service sectors benefit indirectly through improved bilateral trust and long-term trade stability.

- Does the tariff deal improve India’s position in global supply chains?

Yes. By reducing tariff-related uncertainty, the deal strengthens India’s credibility as a reliable sourcing and manufacturing base. This supports global supply-chain diversification strategies, including China-plus-one approaches, and encourages long-term sourcing commitments from US buyers.

- Are there any risks or limitations businesses should consider despite the tariff deal?

Yes. The deal does not eliminate non-tariff barriers such as regulatory compliance, product standards, logistics costs, or currency volatility. Trade policies may also evolve with political changes. Businesses should view the tariff deal as a risk-reduction measure, not a guaranteed growth driver.