India–EU Free Trade Agreement: What It Really Means for MSMEs, Businesses, and India’s Economy

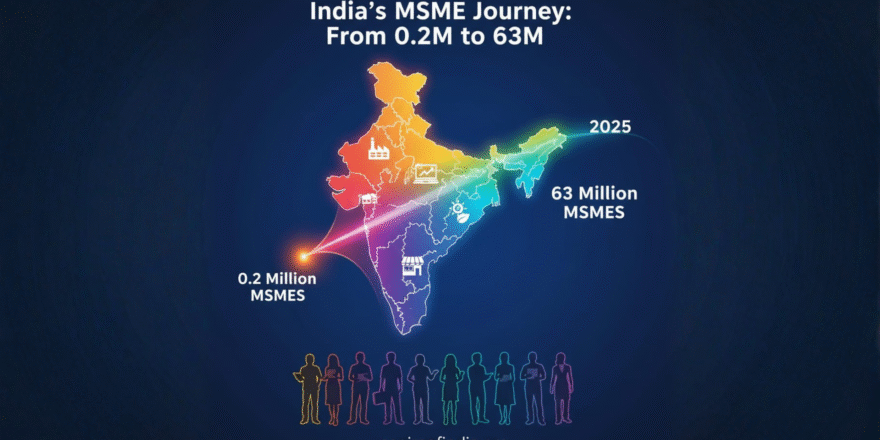

The announcement of the India–EU Free Trade Agreement for MSMEs in early 2026 has been hailed as a transformative “game changer” for the Indian export landscape. The EU is one of the world’s biggest and richest buyer markets, worth a 23-trillion-dollar European market. Many small Indian businesses have not fully tapped into it yet. The new trade pact lowers tariffs and opens doors with preferential market access, but for firms in Noida export clusters, it’s not that simple.

This deal is more than just selling more goods. It changes how Indian businesses make products, keep records, follow rules, and compete worldwide. For an entrepreneurship network in India, this represents the most significant bridge to global value chain integration in decades.

The Historical Context: Why 2026 is Different

India and the EU have increased their trade over the years, but a full free trade deal was hard to reach. Issues like market access, data safety, and sustainability standards caused delays. Now, the India-EU FTA business benefits 2026 talks have broken through because global supply chains are changing.

Europe wants to source from more places, not just one country. India is ready as a trusted place to make goods. For the Delhi-NCR startup ecosystem, this means “Made in India” products must also meet sustainability standards to sell in Europe.

The Positive Impact: Where the Opportunity Lies

1. Price Competitiveness through Tariff Elimination

The most immediate advantage is the creation of zero-duty export sectors between India and the EU. Historically, Indian exporters faced duties ranging from 4% to 12% in key categories, often losing out to competitors from countries with existing EU pacts.

Textiles and Leather: These sectors, vital to Uttar Pradesh MSME support initiatives, now enjoy immediate duty-free entry.

Engineering and Auto Components: These industries can leverage the FTA to offset logistical costs, making their pricing more aggressive in the European heartland.

2. Moving Up the Value Chain

The FTA allows Indian firms to move beyond transactional, low-margin bulk supply. With clearer rules, MSMEs can secure long-term contracts as Tier-2 or Tier-3 suppliers within European industrial ecosystems. This is a shift from “selling a product” to “integrating into a system”.

3. A Predictable Trade Environment

Uncertainty is often a bigger barrier than taxes. The FTA’s focus on transparency reduces customs delays and arbitrary rejections. For a startup consultancy for government schemes in Noida, this predictability allows us to help businesses plan multi-year expansion strategies with higher confidence.

The Hard Truth: The Compliance Challenge

The EU operates on the principle of “Standards First, Tariffs Second.” Even with zero duties, Indian exporters face rigorous non-tariff barriers.

Product Safety: Strict adherence to REACH compliance (chemicals) and safety certifications is mandatory.

Sustainability Standards: The EU carbon tax (CBAM) impact is a reality. European buyers now demand credible data on energy consumption and carbon footprints.

Traceability: From the raw material to the finished product, every step must be documented.

For many, this requires a technology upgradation grant or a quality certification subsidy for MSMEs to overhaul existing production lines.

Navigating Government Schemes for MSME to Achieve FTA Readiness

To compete in Europe, Indian businesses must utilize the robust list of government schemes for MSMEs in India. At ASPIRE, our startup consultancy for government schemes in Noida specializes in aligning these subsidies with export requirements.

Financial Foundations: PMEGP and CGTMSE

The PMEGP scheme for new businesses remains the cornerstone for first-generation entrepreneurs. By securing the PMEGP subsidy for entrepreneurs, startups can build the infrastructure needed for export-grade manufacturing. We provide end-to-end guidance on government schemes for entrepreneurs, including how to apply for PMEGP online to ensure a seamless capital infusion.

For established units looking to expand without pledging assets, the CGTMSE scheme for small businesses offers MSME loan schemes without collateral. These collateral-free MSME loans are essential for scaling production to meet the high-volume demands of European retailers.

Modernizing through the ASPIRE Scheme

The ASPIRE scheme government subsidy is specifically designed to promote innovation and rural industry. Through livelihood business incubators (LBI), the scheme helps MSMEs adopt the advanced machinery required to meet European quality benchmarks. Using an energy audit subsidy for industries or a water conservation subsidy for factories further ensures that your facility aligns with the EU’s “Green Deal” requirements.

Strategic Support: From Funding to Recovery

A successful export business requires more than just manufacturing; it requires a secure financial ecosystem. India’s largest entrepreneurship network highlights the importance of liquidity.

Payment Security: Many MSMEs fear international trade due to payment risks. We offer MSME payment recovery services and access to a dedicated payment recovery cell for MSMEs.

Legal Protections: Our legal support for MSMEs in India assists in business payment dispute resolution, ensuring that commercial payment recovery India processes are followed if an international or domestic buyer defaults.

Operational Efficiency: Utilizing a solar subsidy for MSMEs can drastically reduce overheads, making your export pricing even more competitive.

Segment-Wise Impact Analysis

In the context of the India–EU Free Trade Agreement for MSMEs, the impact varies significantly across different business categories:

Micro Enterprises: These units have a major opportunity to participate in cluster-based exports through livelihood business incubators (LBI). However, their primary risk is the high cost of obtaining the mandatory quality certification for export required by European buyers.

Small Businesses: The biggest win for this segment is gaining access to zero-duty export sectors in India and the EU, such as textiles and leather. Their main challenge will be navigating the EU carbon tax (CBAM) impact, which could add new costs to carbon-intensive products.

Startups: For new ventures, the Startup India schemes for startups provide the necessary runway to innovate for the European market. Their primary risk lies in staying compliant with the rapidly changing EU digital regulations and data privacy laws.

Mid-Sized Firms: These companies are best positioned for global value chain integration, allowing them to become long-term partners for European giants. Their main threat is the increased competition from high-tech EU imports entering the Indian market at lower tariff rates.

The Role of Noida and Uttar Pradesh

As a hub for electronics, leather, and apparel, the Noida export clusters are uniquely positioned to lead the FTA charge. With localized Uttar Pradesh MSME support, businesses in this region can access business subsidies in Haryana/Uttar Pradesh specifically tailored for export-orientated units. Our consultancy acts as the bridge, ensuring that the entrepreneurship network in India is fully informed of MSME schemes for 2025 and beyond.

Conclusion: A Filter, Not a Shortcut

The India–EU Free Trade Agreement for MSMEs is a filter. It will reward those who invest in quality, transparency, and sustainability. It will challenge those who rely on informal processes and low-cost, low-quality models.

By leveraging startup funding schemes by the government and expert legal recovery services for entrepreneurs, Indian businesses can mitigate risks. The journey to a 23-trillion-dollar European market begins with a single step: upgrading your standards today to meet the demands of tomorrow.

Frequently Asked Questions (FAQs)

1. What is the India–EU Free Trade Agreement for MSMEs?

The India–EU Free Trade Agreement for MSMEs cuts taxes on goods and fixes rules to make selling to the EU easier. It helps small businesses reach zero-duty export sectors in India and the EU, like clothes and shoes. Now, Indian MSMEs can compete better in Europe with lower costs and clear guidelines.

2. How do the India-EU FTA business benefits in 2026 help MSMEs?

The India-EU FTA business benefits in 2026 give small firms easy entry to big EU markets and spots in supply chains. The ASPIRE scheme government subsidy pays for needed changes like better tools. MSMEs get steady orders and growth, turning local makers into global players step by step.

3. What compliance is needed for EU exports?

For EU sales, firms must meet EU carbon tax (CBAM) impact, sustainability standards, and quality certification for export. This means checks on pollution, green practices, and product safety. Collateral-free MSME loans help pay for audits and fixes so small businesses can follow rules without big upfront costs.

4. How can Noida businesses prepare?

Startup consultancy for government schemes in Noida gives Uttar Pradesh MSME support like the PMEGP subsidy for entrepreneurs and technology upgrade grants. Local firms learn EU rules, get funds for machines, and join training. This readies Noida export clusters for big EU orders fast.

5. What subsidies aid FTA readiness?

Government subsidies for businesses in India, like livelihood business incubators (LBI) and solar subsidies for MSMEs, pay for green upgrades and tools. They help with global value chain integration by covering costs for clean energy and quality checks, making MSMEs ready for EU trade.

© 2026 All Rights Reserved.